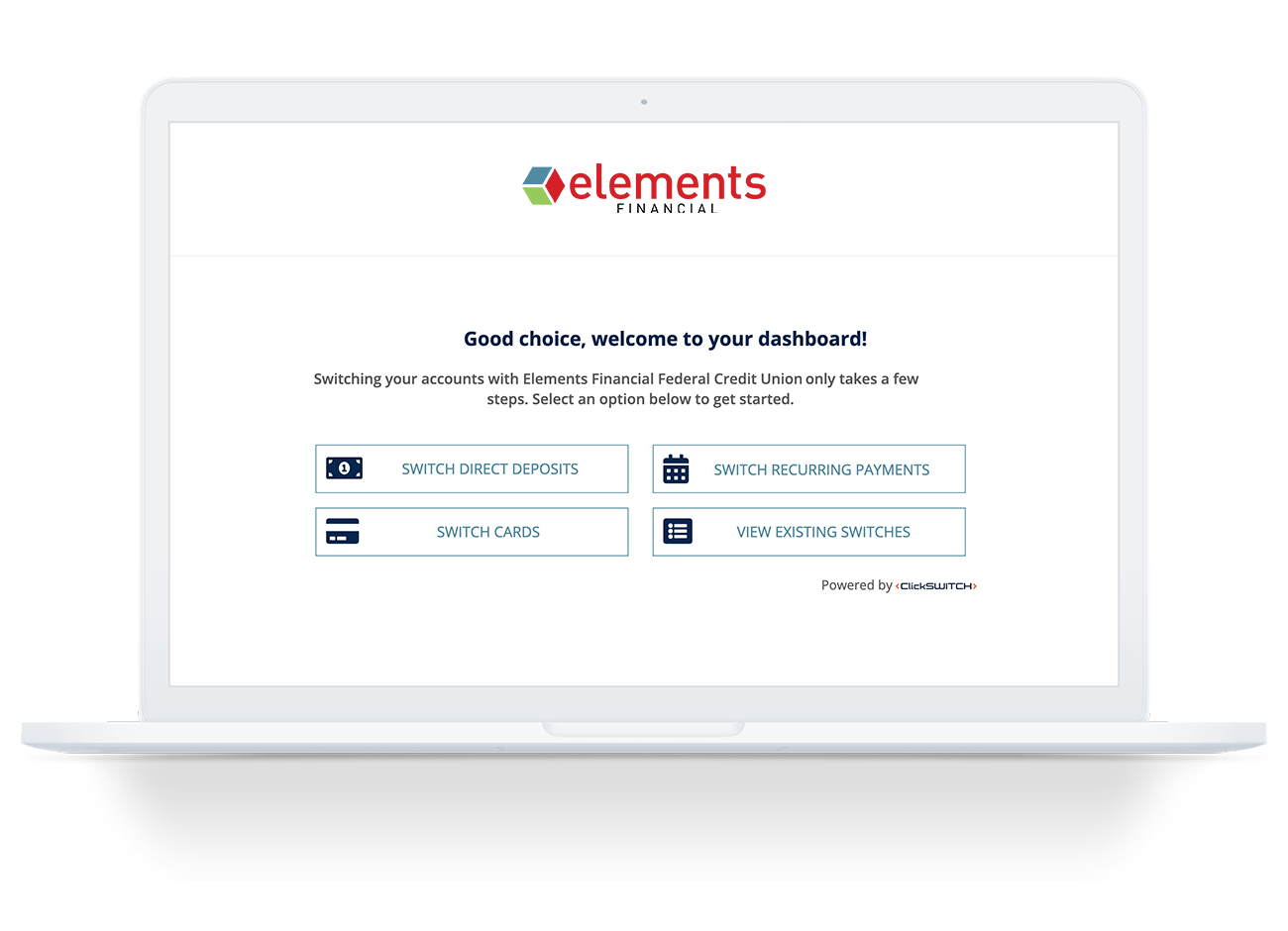

What information is stored within ClickSWITCH?

ClickSWITCH only requests and stores the minimal amount of data required to complete a switch. This information consists of the same details you would see on a blank check. In addition to your name, address, bank account, and routing number, your phone number and email address are also collected.

What is a direct deposit and automatic payment?

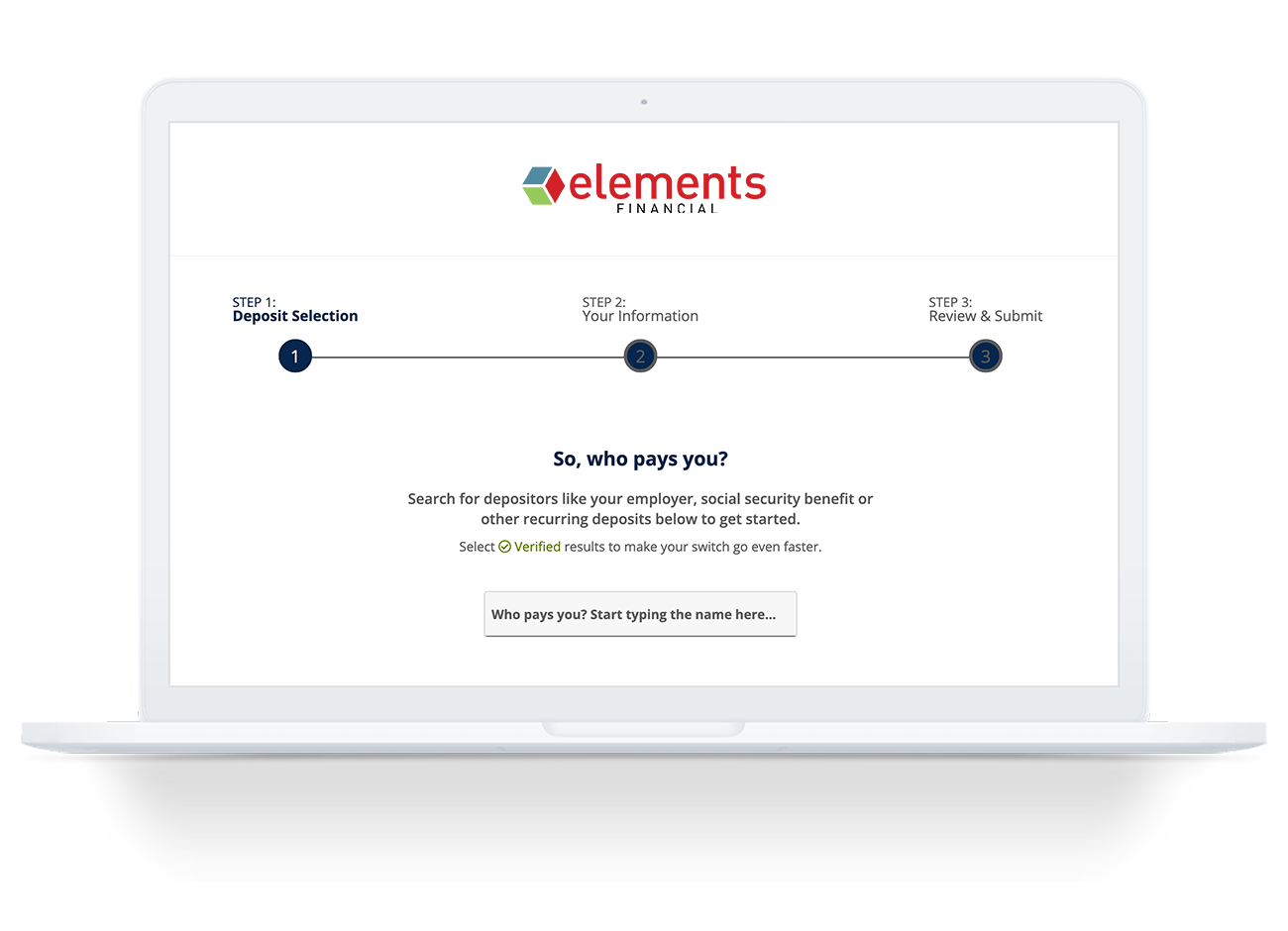

A direct deposit is any payment that you receive from an organization directly into your account. These could include payroll direct deposits, government direct deposits (Social Security, Disability, etc.), and dividend direct deposits from investment accounts.

An automatic payment is a regular, ongoing payment that is initiated externally to your bank account, such as a monthly insurance bill, utility payment or automobile loan payment.

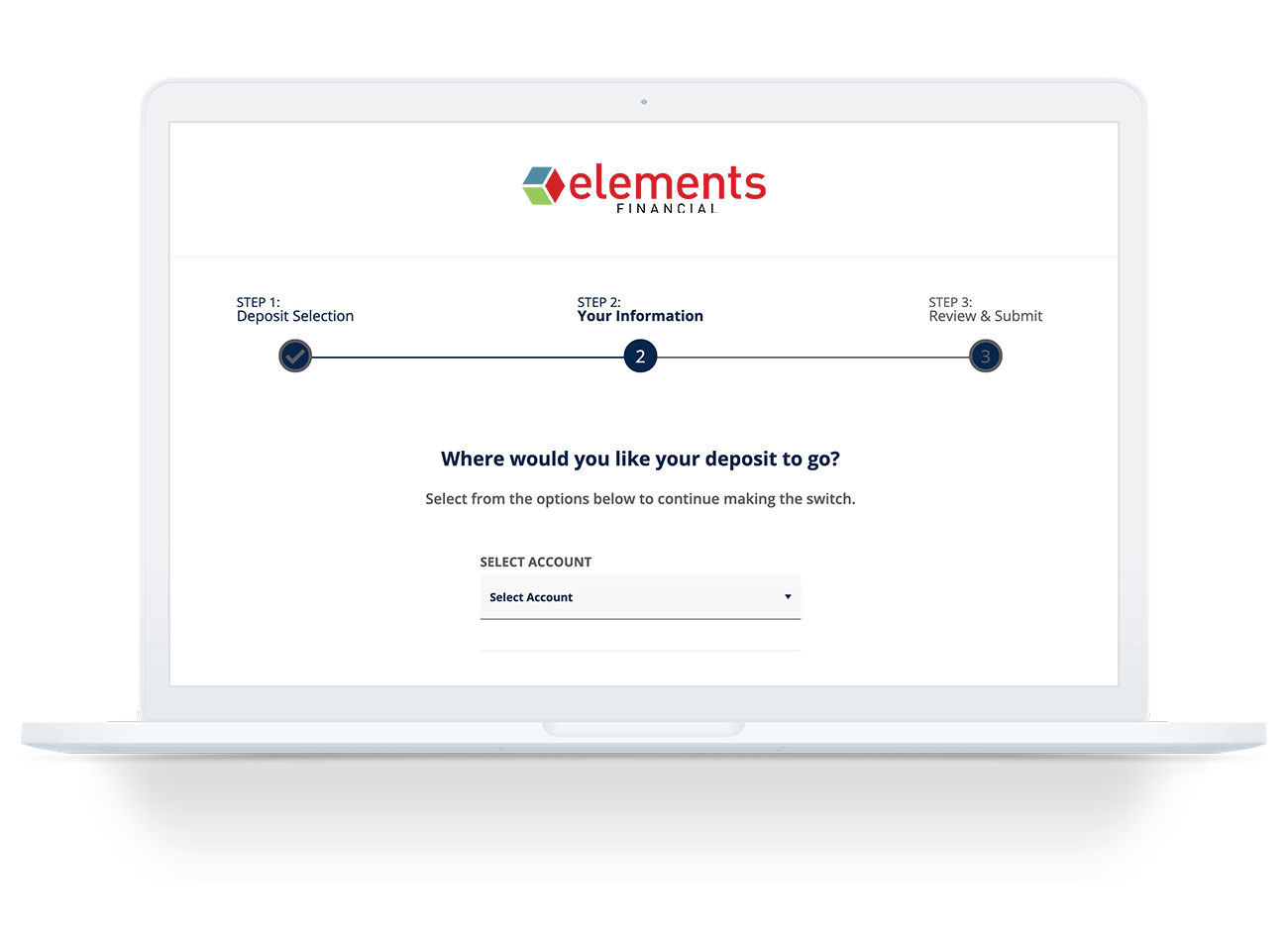

How do I know if my payment or deposit has been switched?

The easiest way to check the status of a switch is to look at the “Status” column of your ClickSWITCH account inside Elements online banking. Switches that have been completed and confirmed by your biller or depositor will display a “Completed” status. Switches that are still in process will display a “Mailed” status. For switches that have a mailed status for 15 days or more, we recommend contacting the company to confirm the switch is completed or check your account.

What if I sent the wrong information to ClickSWITCH?

In most cases, your switch will be rejected and you will receive an email from ClickSWITCH with details on why the rejection happened and what needs to be done next. The exception to this is the Federal Government switches like Social Security. If these are rejected, then Elements is notified and we will reach out to you to complete the switch.

Is ClickSWITCH secure?

Yes. ClickSWITCH uses the latest in online encryption protection to gather and store your switch information. Additionally, ClickSWITCH and Elements adhere to the highest industry standards with regard to the security of your personal information.

What if my switch isn’t completed and I miss a payment?

Monitoring your switch status is an important part of moving your account. It is advisable to keep enough money in your old account to cover each payment until the switch status for that payment has changed to “Completed,” or you’ve confirmed with your billers that your payment account information is updated in their systems.